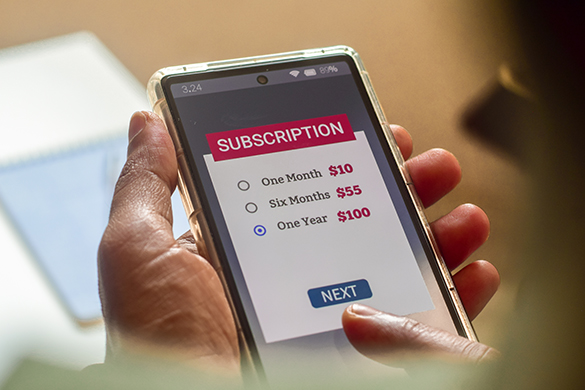

Companies have made it easier than ever to sign up for their services. Many entice consumers with free trial offers that promise easy cancellation if the customer decides they do not want to continue the service. Unfortunately, some companies use unscrupulous tactics to stop people from canceling their subscriptions resulting in exorbitant fees.

At Levin Law, P.A., we provide experienced representation for consumers who have fallen prey to deceptive subscription practices. Companies that violate state or federal law with their auto-renewal subscriptions must be held accountable. If you have sustained losses due to an auto-renewal service, contact our office at (305) 402-9050 to schedule a free case evaluation. Auto-Renewal Subscription Laws

Auto-renewal subscriptions occur when a company automatically renews a subscription or service on behalf of a customer. To incentivize customers to sign up for their service, companies will offer free trials. At the end of the free trial, the company automatically charges the person’s credit card or payment method for the full service.

Federal laws such as the Restore Online Shoppers' Confidence Act protect consumers from unfair and deceptive trade practices regarding services that automatically renew. The seller may not charge customers for any post-transaction services unless all terms have been clearly disclosed and they have received the express informed consent of the consumer.

The Federal Trade Commission (FTC) often refers to these transactions as negative option marketing where the seller takes a customer’s failure to affirmatively act or reject an offer as an agreement to be charged. As noted by the FTC in 2009, negative option marketing may “pose a serious financial risk to consumers” who are not given adequate disclosures and are then billed without their consent.

State Automatic Renewal Laws

In addition to federal regulations that protect consumers, many states have their own statutes regarding automatic renewals. In many jurisdictions, the terms of the automatic renewal as well as the cancellation process must be “clearly and conspicuously” disclosed to be valid. While some state statutes have a very narrow application, many are extraordinarily broad applying to a number of different businesses and scenarios.

Diet app Noom reached a multi-million settlement regarding their automatic renewal process. The company, Noom Inc has agreed to pay $56 million and is offering $6 million in subscription credits to affected customers. According to the lawsuit, the company offered “risk-free” trial periods that required consumers to sign up for a costly automatically renewing subscription. The full service was then difficult to cancel, costing customers significant fees.

Contact Our Office for a Free Case Evaluation

Consumers negatively affected by a auto-renewal subscription are strongly encouraged to contact Levin Law, P.A. for a free case evaluation. Individuals who have sustained losses can contact managing partner and Levin Law founder, Brian Levin directly at (305) 402-9050 or email contact@levinlawpa.com for a free case evaluation.

Most cases are handled on a contingency fee basis, meaning clients are not required to pay Levin Law attorneys fees unless money is recovered on their behalf. Call our office today to discuss your case with a nationally-recognized attorney.

About Levin Law

Levin Law is a premier consumer class action law firm. Brian Levin, Levin Law’s founding attorney, has helped recover in excess of $150,000,000 through arbitration and litigation for individual and institutional investors throughout the country and the rest of the world. Levin Law represents retirees, individual investors, high-net-worth investors, ultra-high-net-worth investors, institutions, family offices, trusts, publicly held companies, and others.